In this article, you will gain insights into the future of environmental liability coverage. As the impact of human activities on the environment continues to be a growing concern, the need for comprehensive and effective insurance coverage becomes increasingly crucial. From emerging risks to evolving regulations and advancements in technology, this exploration delves into key trends shaping the future of environmental liability coverage. By understanding these developments, you can stay ahead and navigate the complex landscape of environmental risk management with confidence.

Understanding Environmental Liability Coverage

Basics of Environmental Liability Insurance

Environmental liability coverage is a type of insurance that provides financial protection against losses or damages caused by environmental pollution or contamination. It is designed to assist policyholders in managing the costs of remediation, cleanup, and legal liabilities associated with environmental damages. This type of coverage typically covers third-party claims resulting from pollution incidents, as well as first-party losses incurred by the insured party.

Who requires Environmental Liability Coverage?

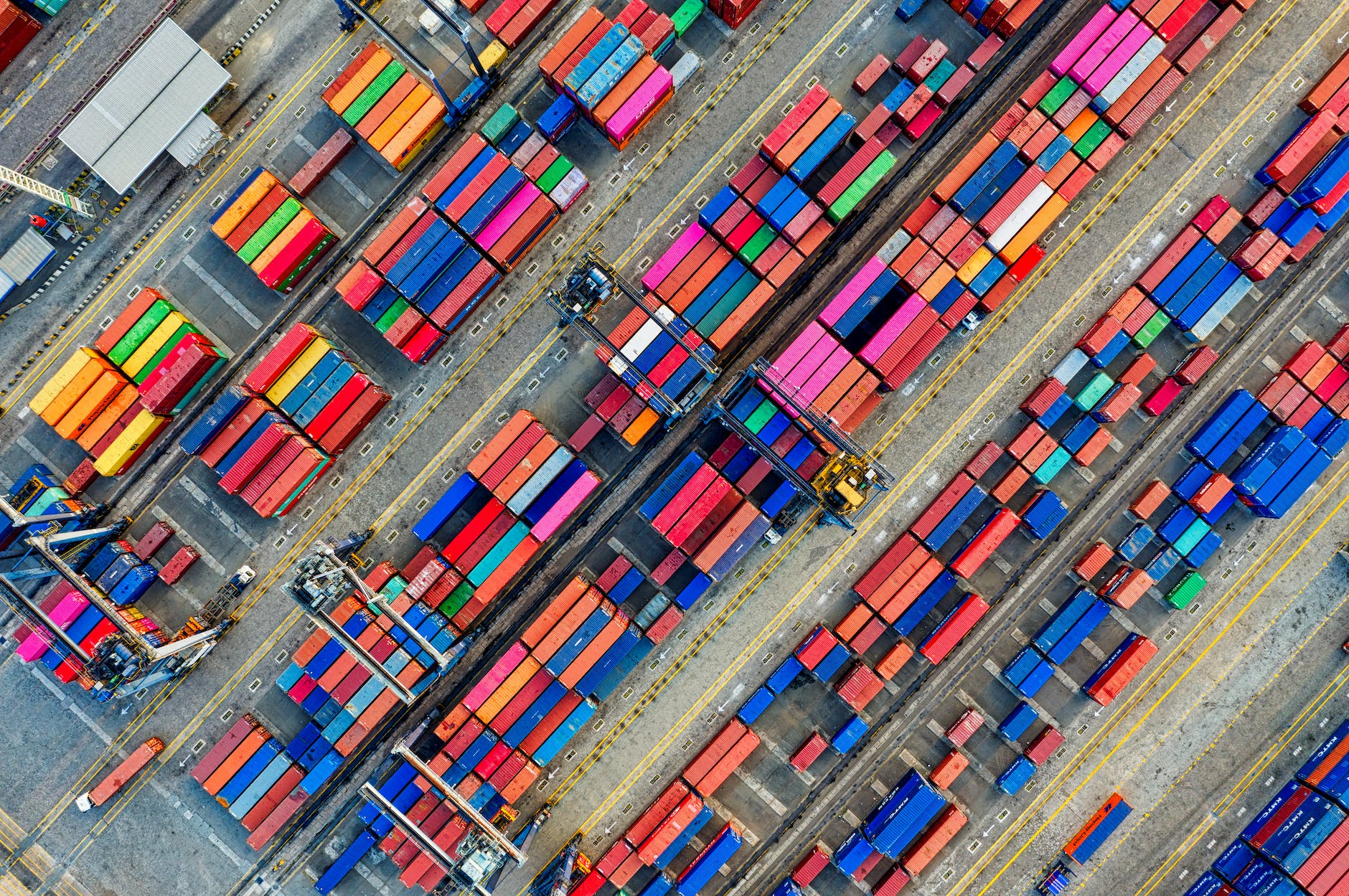

Environmental liability coverage is essential for a wide range of businesses and industries. In particular, companies involved in manufacturing, construction, waste management, transportation, and energy production are often subject to specific environmental regulations. These regulations often require these businesses to carry environmental liability coverage to protect against potential losses and liabilities resulting from their operations.

Different Types of Environmental Liability Coverages

Environmental liability coverage can come in various forms, depending on the specific risks and needs of an organization. Some common types of coverage include pollution legal liability insurance, contractors pollution liability insurance, and premises environmental liability insurance. Additionally, specialized policies such as restoration environmental liability insurance and professional liability insurance for environmental consultants are available to address unique risks in certain industries.

Current State of Environmental Liability Coverage

Market Trends and Coverage Provided

The market for environmental liability coverage has experienced significant growth in recent years. Insurers are recognizing the increasing importance of providing coverage for environmental risks due to stricter regulations and growing public awareness of environmental issues. As a result, insurance carriers have expanded their product offerings to include comprehensive coverage options that address a wide range of environmental liabilities.

Key issues in Present-Day Environmental Liability Coverage

While environmental liability coverage has become more widely available, there are still some challenges and issues that insurers and policyholders face. One key issue is the difficulty in accurately assessing and quantifying environmental risks, as they can vary significantly based on factors such as geographical locations, industry-specific activities, and evolving regulations. Another challenge is the potential for long-tail claims, which may take years or even decades to manifest, making it challenging to estimate future liabilities accurately.

Role of Government Regulations on Environmental Liability Coverage

Government regulations play a crucial role in shaping the landscape of environmental liability coverage. Stricter regulations and enforcement actions have increased the need for such coverage, as businesses are required to comply with environmental laws and regulations. Government initiatives to combat climate change and promote sustainable practices have also influenced the development of policies that address emerging environmental risks. These regulations can drive insurers to adjust and expand their coverage offerings to meet evolving legal requirements and societal expectations.

Impact of Climate Change on Environmental Liability Coverage

How Climate Change is affecting Risks Covered

Climate change has profound implications for environmental liability coverage. Rising temperatures, changing weather patterns, and increased frequency of extreme events such as hurricanes and floods pose new risks for businesses and insurers. These risks include physical damages caused by natural disasters, as well as liabilities arising from potential pollution incidents resulting from climate-related events. Insurers must assess and understand the evolving risks associated with climate change to develop appropriate coverage options.

Insurers’ Response towards increasing environmental risks

Insurers have recognized the need to adapt to the changing landscape of environmental risks caused by climate change. Many insurance companies have incorporated climate risk assessment frameworks into their underwriting processes to evaluate potential losses and liabilities associated with climate-related events. Insurers are also developing innovative products and services that help policyholders mitigate and manage climate-related risks. These efforts include providing guidance on climate adaptation measures and offering coverage options for renewable energy projects.

Climate Change and Future Litigation Scenarios

As awareness of climate change and its impacts grows, there is a possibility of increased litigation related to environmental liabilities. Companies may face lawsuits and claims alleging failure to adequately address climate risks or comply with environmental regulations. Such litigation could result in substantial financial losses and reputational damage. Insurers are closely monitoring legal developments in this area to assess potential coverage implications and adjust policy terms accordingly.

Technological Advancements and Environmental Liability Coverage

Role of Technology in Risk Assessment and Mitigation

Technological advancements play a vital role in enhancing the risk assessment and mitigation capabilities of environmental liability coverage. Sophisticated data analytics tools enable insurers to analyze vast amounts of data and identify potential environmental risks more accurately. Additionally, remote sensing technologies, such as satellite imagery and aerial surveys, provide valuable information for assessing pollution incidents and monitoring environmental impacts. Real-time monitoring systems also help policyholders identify and address environmental risks promptly.

Impact of artificial intelligence on Environmental Liability Coverage

Artificial intelligence (AI) is increasingly being used in environmental liability coverage to improve risk modeling, claims management, and underwriting processes. AI algorithms can analyze large datasets and identify trends and patterns that human analysis may overlook. This technology allows insurers to make more informed decisions and accurately price policies based on the underlying risks. Furthermore, AI-driven claims management systems streamline the claims process and enhance efficiency, resulting in faster claim settlements for policyholders.

Cyber Risks and Environmental Liability Coverage

The growing reliance on technology in environmental risk management also introduces new vulnerabilities. The interconnectedness of systems and the increased use of remote monitoring and control systems create potential cybersecurity risks. A cyberattack targeting environmental infrastructure or systems can lead to substantial environmental damages, as well as legal liabilities for the affected party. Insurers are developing cyber risk coverages that encompass both cyber liability and environmental liability to provide comprehensive protection against these evolving risks.

Legal Developments impacting Environmental Liability Coverage

Important Court Judgments Pertaining to Environmental Liability

Court rulings have a significant impact on the interpretation and implementation of environmental liability coverage. Important legal decisions have addressed issues such as the definition of pollution, coverage for gradual pollution, and allocation of cleanup costs among responsible parties. Court judgments can shape the scope of coverage available and influence insurers’ underwriting practices. It is essential for insurers and policyholders to stay informed about these legal developments to ensure compliance and appropriate risk transfer.

Regional and Global Legal developments

Environmental liability laws and regulations vary across jurisdictions. Some regions have implemented stringent environmental standards, while others are in the process of strengthening their legal frameworks. Global agreements, such as the Paris Agreement, also influence the legal landscape by requiring countries to reduce greenhouse gas emissions and mitigate climate change. Insurance companies must navigate these regional and global legal frameworks to provide effective environmental liability coverage that aligns with local laws and international obligations.

Impact of Legal Developments on Policy Design

Legal developments significantly influence the design and terms of environmental liability policies. Changes in legislation or court rulings can lead to revisions in policy definitions, policy triggers, coverage exclusions, and policy limits. Insurers need to review and update policy language to remain compliant with evolving legal requirements and ensure adequate coverage for policyholders. Legal developments can also create opportunities for insurers to develop tailored products that address emerging risks and meet the changing needs of businesses.

Influence of Sustainability and Corporate Responsibility on Environmental Liability Coverage

Role of ESG (Environmental, Social, and Governance) Factors

Environmental, social, and governance (ESG) factors are increasingly considered in the assessment of environmental liability exposures. Insurance companies are incorporating ESG considerations into their underwriting processes to evaluate the environmental practices and risk management strategies of potential policyholders. By assessing ESG factors, insurers can identify policyholders with strong environmental performance and encourage sustainable practices through preferential coverage terms and pricing.

Influence of Stakeholder Pressure

Stakeholders, including investors, customers, and employees, are becoming more conscious of the environmental impacts of businesses. This increased awareness and pressure for sustainable practices can influence insurance purchasing decisions. Businesses that prioritize environmental responsibility are more likely to seek robust environmental liability coverage to demonstrate their commitment to risk management and protect their stakeholders. Insurers are responding to this demand by developing coverage options that address specific environmental concerns raised by stakeholders.

Corporate Disclosures and Their Impact on Environmental Liability Coverages

Corporate disclosures on environmental performance and risk management practices have a direct impact on environmental liability coverage. Insurers may require detailed information on a company’s environmental policies, procedures, and initiatives as part of the underwriting process. Transparent and comprehensive disclosures can facilitate improved risk assessment and result in more favorable coverage terms. Companies that proactively disclose their environmental efforts and achievements are more likely to secure broader coverage and more competitive premiums.

Future Trends in Environmental Liability Coverage

Expected Future Changes in Environmental Risks

Environmental risks are expected to evolve and intensify in the future due to factors such as climate change, technological advancements, and shifting regulatory landscapes. Rising sea levels, extreme weather events, and the development of new industries and technologies will introduce new risks that require innovative coverage solutions. Insurers must continuously assess and anticipate these emerging risks to provide effective environmental liability coverage that adequately protects policyholders against future environmental liabilities.

Potential New Areas of Coverage

As environmental risks evolve, new areas of coverage may emerge. For example, coverage for carbon capture and storage projects, renewable energy installations, and emerging technologies like drones and autonomous vehicles may become more prevalent in environmental liability coverage. Innovative policies that address potential liabilities associated with emerging risks are expected to emerge as the demand for comprehensive coverage increases. Insurers must stay proactive in identifying and offering coverage for these evolving risks to remain relevant in the market.

Factors influencing Future Trends in Environmental Liability

Several factors will influence the future trends in environmental liability coverage. These include technological advancements, regulatory developments, public perception and awareness, and the availability of reliable environmental data. The interplay of these factors will shape the direction of coverage offerings and drive insurers to adapt their underwriting and claims management processes. Insurers that can effectively navigate these influences will be better positioned to provide comprehensive and tailored environmental liability coverage.

Challenges and Opportunities in the Future of Environmental Liability Coverage

Risk Modeling and Underwriting Challenges

One of the significant challenges in the future of environmental liability coverage is the accurate modeling and assessment of environmental risks. Insurers must leverage advanced data analytics and modeling techniques to capture the complexities of environmental hazards and predict potential losses effectively. Underwriting challenges also arise due to the constantly changing regulatory environment and the evolving nature of emerging risks. Insurers need to develop robust underwriting guidelines and regularly update their risk assessment methodologies to keep up with these challenges.

New Product Development Opportunities

The future of environmental liability coverage presents numerous opportunities for insurers to develop innovative products that address emerging risks. Insurers can leverage their expertise and collaborate with other stakeholders, such as risk consultants and environmental engineers, to create customized coverage options for specific industries or technologies. Developing coverage for new industries and technologies will require a deep understanding of the associated risks and careful consideration of evolving legal frameworks. Insurers that can seize these new product development opportunities stand to gain a competitive advantage in the market.

Challenges in Regulatory Compliance

The ever-changing regulatory landscape presents challenges for insurers in ensuring compliance with environmental liability requirements. Staying abreast of regulatory developments can be complex, especially when operating across multiple jurisdictions with varying legal frameworks. Compliance challenges extend to policyholders as well, as they must navigate the evolving regulations to mitigate their environmental risks effectively. Insurers can support their policyholders by providing up-to-date information on regulatory changes and assisting in developing risk management strategies that align with the changing legal requirements.

Impact of Covid-19 on the Future of Environmental Liability Coverage

Covid-19 and its Influence on Environmental Risks and Claims

The Covid-19 pandemic has had far-reaching impacts on various aspects of society, including the environment. Lockdown measures and reduced economic activity have led to temporary improvements in air quality and reduced pollution in some areas. However, the pandemic has also introduced new risks and challenges, such as increased waste generation from personal protective equipment and disruptions in waste management systems. These shifts in environmental risks may have implications for future environmental liability coverage and claims.

Long-term effect of pandemics on Environmental Insurance

The long-term effects of pandemics on environmental liability coverage remain to be seen. The Covid-19 crisis has highlighted the interconnectedness of global health and environmental issues, leading to heightened awareness of the need for effective risk management. Insurers may need to evaluate the potential for future pandemics and their environmental consequences when assessing and underwriting policies. Additionally, policyholders may seek broader coverage that addresses the potential liabilities arising from future infectious disease outbreaks and their environmental impacts.

Lessons learnt from COVID-19’s impact on Environmental Liability Coverage

The Covid-19 pandemic has provided valuable lessons for insurers and policyholders regarding the importance of preparedness and resilience in managing environmental risks. It has underscored the need for agile and adaptable coverage options that can respond to rapidly changing circumstances. Insurers may incorporate pandemic-related exclusions or endorsements into environmental liability policies to address specific risks associated with infectious diseases. Policyholders, on the other hand, may invest in enhanced risk management measures and seek comprehensive coverage that encompasses potential environmental liabilities arising from future pandemics.

Preparing for the Future of Environmental Liability Coverage

Future Proof Underwriting Process

To prepare for the future of environmental liability coverage, insurers need to develop future-proof underwriting processes that can effectively evaluate evolving risks. This requires leveraging advanced data analytics, modeling tools, and risk assessment frameworks that encompass a wide range of environmental hazards and scenarios. Insurers should also invest in continuous education and training programs to keep their underwriters updated on emerging risks and best practices in environmental risk management.

Role of Innovation and Adaptation

Innovation and adaptation are key to the future of environmental liability coverage. Insurers that embrace new technologies, such as AI and remote sensing, can gain a competitive edge in accurately assessing risks and pricing policies. Embracing innovative coverage options, such as parametric or index-based insurance, can provide policyholders with faster and more transparent claim settlements. Additionally, insurers must adapt their coverage offerings to address emerging risks, regulatory changes, and societal expectations concerning sustainable practices.

Educating Policyholders on Future Environmental Risks

Effective communication and education are crucial in preparing policyholders for future environmental risks and the importance of adequate coverage. Insurers should provide resources, guidelines, and risk management tools to help policyholders identify and mitigate potential environmental liabilities. This can include offering training programs, webinars, and whitepapers that address emerging risks, regulatory updates, and best practices. By proactively educating policyholders, insurers can foster a culture of risk awareness and resilience, ultimately reducing environmental liabilities and claims.

In conclusion, understanding environmental liability coverage is essential for businesses and industries facing potential environmental risks and liabilities. As the future unfolds, insurers must adapt to emerging trends, such as climate change, technological advancements, and evolving legal frameworks, to provide effective coverage options. By embracing innovative approaches, educating policyholders, and continuously assessing environmental risks, insurers can prepare for the future and contribute to sustainable risk management practices.